Managed Accounts in TheBooks

Trading managed accounts brings with it many complexities that trading a fund does not. DMAXX has more than twenty years of experience working with advisors who trade managed accounts. TheBooks has many features designed specifically for these types of advisors and is used by advisors with a wide range of sizes and trading styles.

These are just a few of the areas TheBooks provides capabilities that allow managed accounts to be handled with ease:

Block trade creation and order sizing

Fill price allocation

Counter-party notification of trading activity

Reconciling multiple clearing relationships

Management and incentive fee calculation

Account transparency and liquidity

The sections below provide an overview of how TheBooks addresses these critical needs of the alternative investment manager with managed accounts.

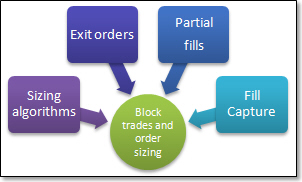

Block trade creation and order sizing

When multiple accounts are being traded, order sizing becomes more complex as contract rounding and position exiting become issues. For those organizations that ladder into and out of positions, the complexities of these issues are magnified.

TheBooks provides several capabilities which simplify order creation and sizing when multiple accounts are being traded:

Multiple trade sizing algorithms

Exit/Roll/Account Resize order creation based on existing positions (by trading system/strategy, if required)

Partial trade completion on next session

Automatic fill capture via FIX drop copy can create new orders or be associated with pre-built orders

Trade Sizing

Each account in TheBooks has a trading size (sometimes called trading level) which is independent of the accounts equity level. One of the primary uses for trading size is to assist in order sizing.

The table below details how each of the methods work:

| Contracts per million of trading size | Each account in a block trade is assigned a number of contracts based on a specified number of contracts per million of trading size |

| Fixed order size | Each account in a block is given their relative portion of the total quantity based on their trading size as a portion of the total trading size of accounts within the block |

| Target level | First the number of contracts that each account should get is determined based on the Contracts per million method. Then, TheBooks looks at how many contracts the accounts within the block actually have on and sizes the trade such that if the trade is fully filled, the accounts will have the specified number of contracts per million as open positions. |

| User-defined | Both the user interface and the programming interface have facilities to allow the user to specify exactly the number of contracts each account is to receive. |

In addition to these methods, TheBooks provides complete support for trading systems (sometimes known as strategies) and allows you to build trades that have components from multiple systems, going is opposite directions if needed.

Exit, roll, and account resizing order creation

TheBooks automatically maintains positions for each of your accounts as you trade. The positions are maintained both by system (if enabled) as well as by what the street sees. It includes tools to allow you to quickly create exit and roll trades based on your current positions as well as the trades required to resize an account based on a change in trading level. In addition, there is the ability to create the trades required to bring a new account up to the appropriate trading level using any other account as a model.

Partial fill handling

As your assets under management grow, the size of trades you need to execute increases. Even in many of the most liquid markets, you may not be able to get an entire trade executed during a session, resulting in a partially filled order. TheBooks includes the ability to fairly allocate the partially filled trade as well as being able to create a trade for the unfilled portion. This is especially useful when trading multiple strategies, as a single trade may have components from multiple systems. When allocating a partially filled trade, TheBooks will allocate contracts across the various systems for each account and when it creates the trade for the unfilled portion, the new trade is made up of those systems and accounts that were not able to be fully filled by the original trade.

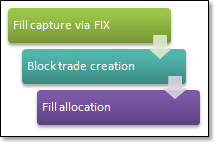

FIX drop and post trade allocation

As trading occurs, fills, regardless of source, can be automatically routed to TheBooks via FIX connections. Fills for each ticket are consolidated into trades within TheBooks and are typically booked to what is known as a holding account.

After a logical trade has been completed, the trader or back office personnel select the ticket(s) which make up the logical trade and associate them with the group of accounts which are to be assigned to the trade. This process can be performed automatically as well if desired. As an option, the trade can be associated with one or more strategy (or system) to allow tracking of virtual positions and performance by strategy.

Contract quantities are automatically assigned based on the each account’s relative trading size and once saved, quantities and fill prices are allocated to the accounts.

If the advisor wants to work up trades in advance of execution (using TheBooks ability to combine trades from multiple systems/strategies, for example), the assignment of the ticket to the block of accounts can also be done by simply selecting an existing trade rather than specifying a group of accounts. In that case, the fills from the tickets are “pushed” into the existing trade.

Fill price allocation

When block trades are filled with multiple fill prices, the issue of allocating fill prices amongst the accounts which make up the block become paramount. NFA rules state that the allocation process used by an advisor must be "Fair and Consistent."

TheBooks provides the advisor several options to choose from when deciding how the firm should perform these allocations:

Low price to low account number

Low price to high account number

Weighted average (each account gets a mixed fill with an average close to the trades average)

APS for those markets that allow it

In addition to these, TheBooks allows you to indicate that one or more accounts should always receive the worst fills. This is particularly important if you are trading proprietary money within the same trades as your investor's money. Using this option ensures that your investors always get the best fills.

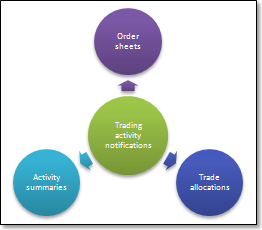

Counter-party notification of trading activity

Counter-party notification of trading activity is used to send trading-specific information to trading desks, back offices, and other organizations that require information about trades that you plan to execute or have executed. As the number of managed accounts you trade increases, the number of counter-parties increase as well. With that comes an increasing number of formats and transmission methods.

TheBooks allows you to to define three broad types of trading activity to send:

Order Sheets, sometimes called breakdowns

These are used to communicate your intention to execute a trade. The most common use of the order sheet is for sending orders to a trading desk. Often, a systematic trader will generate orders at the end of the day for execution the following day. The order sheets are used to transmit these orders to the brokers that will be executing the trade.

Allocations, sometimes called trade tickets

These are used to communicate the quantity/fill price allocation for a filled order back to the executing broker. These tickets provide a written audit trail to ensure that the accounts which make up a block trade are given fills in a fair an consistent manner per your allocation rules.

Activity summaries

These are used to communicate summarized trading information after a trade has been filled. They are often used to provide a daily re-cap of trading activity for a number of accounts to a broker's back office or to some other third party such as accountants or the investor.

These types of data can be sent as reports or as data files. In the case of data files, they are end-user customizable and you can even specify symbology translations if your counter-party uses a different symbology than you do. The reports and/or data files can be emailed or FTPed (FTP, sFTP, FTPs), or sent by a user-written transport method from TheBooks.

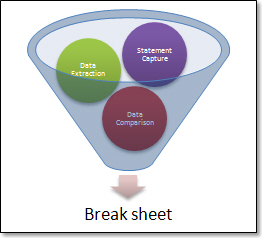

Reconciling multiple clearing relationships

Any CTA with managed accounts knows that one of the most time-consuming aspects of the job is reconciling your books and records with those of your clearing brokers. This becomes an especially arduous task when you have clearing relationships with multiple brokers. It seems that no two brokers have the same statement format, use the same symbology, or adhere to a consistent price convention.

What makes things even more frustrating is that most of the effort is spent reviewing trades that are correct in order to locate the ones that are wrong.

TheBooks reconciler automates this process and presents you with the trades, positions, and balances that do not agree, eliminating the tedious process of manually locating discrepancies.

Statements, not data files

TheBooks reconciler reads human-readable statements, not data files. This allows you and the software to use the same source when reviewing the information provided by your brokers.

TheBooks includes the capability to automatically receive and identify statements via email and reach out and download statements from FTP sites. If you must manually obtain your statements from a web site, you simply drop the statement file into a folder and TheBooks will automatically process it.

In addition, TheBooks automatically organizes, encrypts, and compresses your statements and saves them within its database providing a single point for backup. It also includes facilities for exporting your statements onto disk in an organized fashion allowing you easily prepare for audits.

Only the issues

When you ask the reconciler to look for differences, it only shows you the trades (or positions, or balances) that are different. You then spend your time resolving the issues; rather than looking for the issues. In addition, TheBooks reconciler maintains a list of open trade breaks and includes them on any break sheet you send to your brokers.

As missed or extra trades are corrected on your statements, they are automatically removed from the list of open breaks. Price corrections are also detected and reported.

Management and incentive fee calculations

Every manager knows that a uniform management and incentive fee structure across all of their managed accounts, while highly desirable, is not the reality of the investment world. Management and Incentive fees are configurable at the account-level in TheBooks. In addition, they are formula-based, meaning complex fee structures such as hurdle rates, tiered management fees based on assets, and fees based on beginning or ending monthly equity levels are possible.

Both management and incentive fees are calculated on a daily basis so your clients can be provided accurate NAVs on a daily basis and you always know what your expected fees are as of any given date. High water marks are automatically managed as the result of additions and withdrawals and TheBooks also provided the ability to generate invoices or provide Excel® sheets in those situations where billing information is provided to clearing brokers rather than directly to your clients.

Finally, if your program includes both futures and FX and the holdings are at multiple brokers for a given investor, TheBooks will perform fee calculations based on the net performance of all accounts which make up the investor's managed account.

Account transparency and liquidity

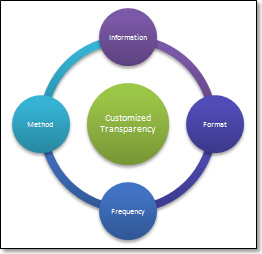

Investors want transparency; it is what is behind the move from funds to

managed accounts. TheBooks provides you the ability to provide what we

call Customized Transparency.

Investors want transparency; it is what is behind the move from funds to

managed accounts. TheBooks provides you the ability to provide what we

call Customized Transparency.

This is the ability to provide:

the information the investor wants

in the format they want

with the frequency they want delivered

sent using the method they want

Whether it means providing daily returns as a PDF document via email, instrument returns as an Excel® spreadsheet via FTP, or positions as a CSV file via sFTP, TheBooks provides you with the ability to easily configure what reports go to what contacts, in what formats, sent by what method.

Daily liquidity

TheBooks is a daily system. All transactions, calculations, and accruals are done on a daily basis. Performance calculations are done using the daily compounded method allowing daily additions and withdrawals to easily be incorporated into performance. Daily NAVs are automatically available and as a result, you can easily provide daily liquidity to your investors.

Summary

Managed accounts are the new reality for the alternative investment manager. DMAXX has been providing software exclusively to advisors with managed accounts for more than twenty years and developed TheBooks to specifically to meet the unique needs of the alternative investment manager with managed accounts. The capabilities described here provides an overview of just some of the managed account-specific capabilities provided by TheBooks and are some of the reasons why TheBooks is the system of choice for CTAs around the world.