Execution Gateway

Execution Gateways extend the Trading Desk concept in TheBooks and allows the routing of trades directly to exchanges for execution. As trades are filled, they are automatically updated in TheBooks and for those gateways that have an associated trading platform, trades can be worked from within the platform; TheBooks automatically records your actions.

Advanced execution options

TheBooks provides several advanced execution options tailored to systematic institutional advisors:

Iceberged limit orders

Virtual trading days

Custom handling of blown stops on order release

MOO and MOC gap handling

Automatic email alerting of order status when trigger prices are reached

Electronic Give-up

When the trade is complete, TheBooks performs price allocation to the accounts which make up the trade and give-up and breakdown information is passed electronically to the clearing brokers, providing seamless execution and reporting of the trade.

Supported Trading Platforms

TheBooks provides full, bi-directional integration with the following trading platforms:

TradeStation

TheBooks also includes a generic FIX 4.2/4.4 execution interface allowing it to communicate with most FIX-compliant platforms as well.

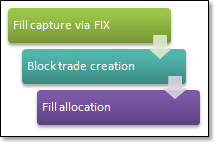

FIX Drop Copy and post trade allocation

TheBooks execution gateway provides FIX drop copy (execution report; record type 8) support allowing trades to automatically be routed into TheBooks as they are filled.

As trading occurs, fills, regardless of source, can be automatically routed to TheBooks

via FIX connections. Fills for each ticket are consolidated into trades within TheBooks

and are typically booked to what is known as a holding account.

As trading occurs, fills, regardless of source, can be automatically routed to TheBooks

via FIX connections. Fills for each ticket are consolidated into trades within TheBooks

and are typically booked to what is known as a holding account.

After a logical trade has been completed, the trader or back office personnel select the ticket(s) which make up the logical trade and associate them with the group of accounts which are to be assigned to the trade. This process can be performed automatically as well if desired. As an option, the trade can be associated with one or more strategy (or system) to allow tracking of virtual positions and performance by strategy.

Contract quantities are automatically assigned based on the each account’s relative trading size and once saved, quantities and fill prices are allocated to the accounts.

If the advisor wants to work up trades in advance of execution (using TheBooks ability to combine trades from multiple systems/strategies, for example), the assignment of the ticket to the block of accounts can also be done by simply selecting an existing trade rather than specifying a group of accounts. In that case, the fills from the tickets are “pushed” into the existing trade.

Straight-through processing

Whether a trade originates in the trading platform, generated by software, or is manually created in TheBooks, trade processing and reporting is automatically performed.

The goal of complete automation, from trade inception through performance fee calculation is now accessable to any advisor.